pay ohio unemployment taxes online

File Unemployment Taxes Online. Helps students to turn their drafts into complete essays of Pro level.

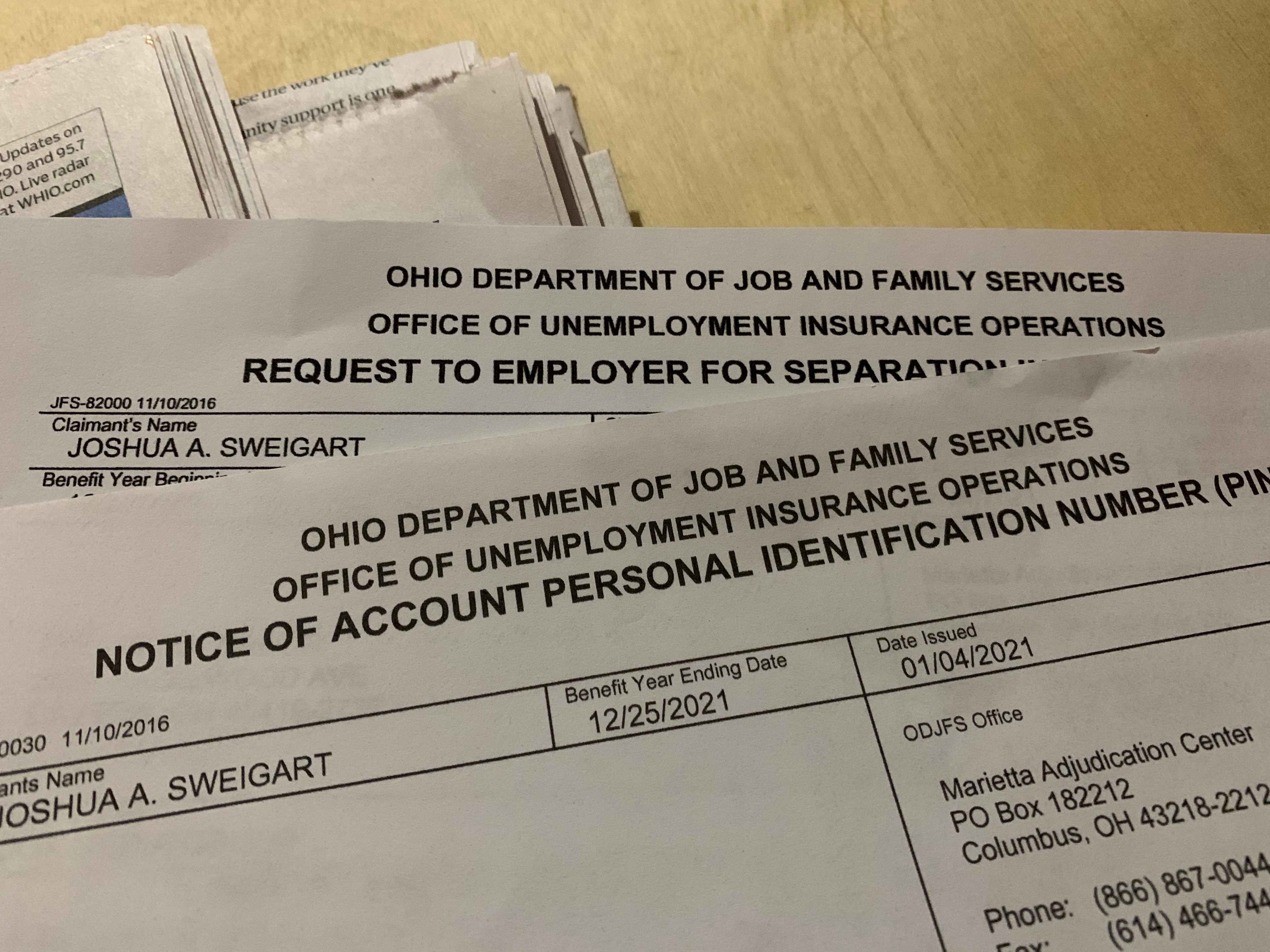

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

The Bureau of Labor Statistics BLS publishes a range of indicators that point to the extent to which labor resources are being utilized.

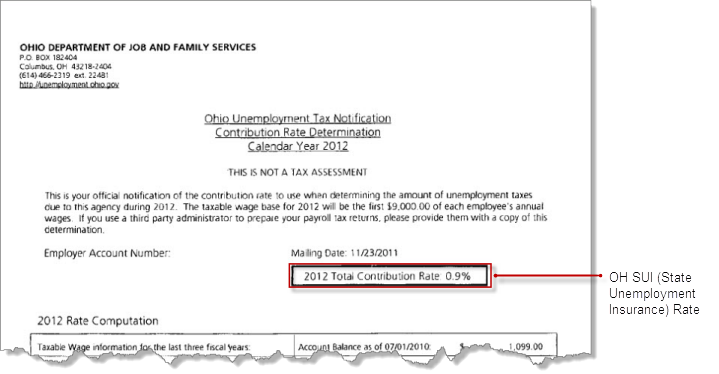

. Our online services is trustworthy and it cares about your learning and your degree. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at thesourcejfsohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO. 2011 2012 2013 Lowest Experience Rate.

The same is true for state unemployment programs except the wage base limits vary and in a few states employees also contribute to the tax. The local treasurers office has very little flexibility in most tax collection matters. Hence you should be sure of the fact that our online essay help cannot harm your academic life.

Unemployment taxes paid are credited to an employers account. Ohio Administrative Code 510112-10-03 specifies when a CSEA may transfer a case to a CSEA in another county. Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current.

Installment Agreement Request POPULAR FOR TAX PROS. Additionally you must also pay the matching employer portion of social security and Medicare taxes as well as pay unemployment tax on wages paid to an employee. The Best and Worst States to Pay Taxes on Lottery Winnings.

To apply online employees should go to unemploymentohiogov and click on Employee then Unemployment Login Click here for a step-by-step guide to applying online. This service is similar to paying a tutor to help improve your skills. News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook.

Unemployment Fiscal Policy Monetary Policy Public Policy News US Economy News Banking Banking. States With the Estate and Inheritance Taxes. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax.

Massachusetts woman accused of weaponizing bees to stop officers trying to enforce eviction. The Bureau of Unemployment Compensation UC Benefits is responsible for the development of policies and procedures for the statewide administration of the UC Benefits Program. With course help online you pay for academic writing help and we give you a legal service.

See IRSgov for details. Known as U1 U2 and U4 through U6 U3 is the official unemployment rate these alternative measures of labor underutilization provide insight into a broad range of problems workers encounter in todays labor market. Apply for Unemployment Now Employee 1099 Employee Employer.

Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Applying online is the quickest way to start receiving unemployment benefits. Highlighted below are two important pieces of information to help you register your business and begin reporting.

Government Publishing Office Page 134 STAT. The more pages you order the less you pay. Giving you the feedback you need to break new grounds with your writing.

Home O hiogov Search Menu. Employer taxes and reimbursements support the Unemployment Trust Fund. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

22150 and 221300. If employees dont have access to a computer they can apply by phone by calling 877-644-6562. Below you will find some of the most frequently asked questions about real estate taxes.

My child support order says both parents are each supposed. Please understand that most policies regarding real estate taxes are set by the Ohio Revised Code ORC. Employers engaged in a trade or business who pay compensation Form 9465.

Fine-crafting custom academic essays for each individuals success - on time. Employers cannot deduct any money from employees paychecks to pay for this program. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Generally you must withhold and deposit income taxes social security taxes and Medicare taxes from the wages paid to an employee. Get the latest international news and world events from Asia Europe the Middle East and more.

While taxable employers claim the WOTC against income taxes eligible tax-exempt employers can claim the WOTC only against payroll taxes and only for wages paid to members of the. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Unemployment taxes Employers alone pay federal unemployment tax FUTA on the first 7000 that every employee earns.

Report it by calling toll-free. Fraud alert text appearing to be from your bank will get your attention but it could be a scam. Answers to the questions are also provided.

116th Congress Public Law 136 From the US. To find out if your case may be transferred contact your current CSEA. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage.

Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. Ohio 0 to 4797. Additional information about the Ohio Unemployment Tax can be obtained from our.

Box 182404 Columbus Ohio 43218-2404If you report your liability at thesourcejfsohiogov you will receive a determination immediately. Massachusetts woman accused of weaponizing bees to stop officers trying to enforce eviction. Unemployment benefits paid to eligible claimants are.

Ohio Paycheck Calculator Smartasset

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

/cloudfront-us-east-1.images.arcpublishing.com/gray/64DBYNBNHNCNVPMVQJC6NF7E7M.jpg)

Get An Ohio 1099 G Tax Form But Didn T Apply For Unemployment Here S What To Do

How To Apply For Unemployment Benefits Online In Ohio Youtube

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Unemployment Tax Updates To Turbotax And H R Block

Some People Not Receiving Unemployment 1099 G Tax Forms

/cloudfront-us-east-1.images.arcpublishing.com/gray/5BNGIVBY5BFQDHIDXVARCYZGKM.png)

Pandemic Unemployment Assistance Now Available For Ohioans

Struggling To File Your Unemployment Claim Here S Why

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Auglaize County Sheriff S Office We Have Received Several Calls Regarding Citizens Receiving 1099 G Forms That Have Not Filed For Unemployment We Ask That You File A Report With Ohio Department Of

Guide To Ohio Unemployment Insurance Benefits

Overwhelmed And Underprepared Unemployment System Fails Ohioans

Ohio Employment Taxes Farm Office

Coronavirus In Ohio How To Apply For Unemployment If You Ve Been Impacted By Covid 19 Nbc4 Wcmh Tv

Unemployment Benefits In Ohio How To Get The Tax Break

Ohio Adds Unemployment Security Feature Says Previously Denied Pua Claims May Now Be Eligible